Table Of Content

The figure that is reached helps determine the taxes due on the property and how to divide the estate equitably. The best way to get a more precise estimate of what a home appraisal will cost in your area is to contact your real estate agent or mortgage lender. Depending on the size of the property, the appraisal could take anywhere from 20 minutes to a few hours. During this time, the appraiser will review the home’s condition and will take photos of the living areas as documentation.

Are online valuations the same as an appraisal?

Unless it is a cash-only home purchase, an appraiser is an impartial third party who can confirm or complicate the deal by providing an evaluation of the home’s value. Lenders rely on professional home appraisals to determine whether the home is at least equal to the value of the agreed-upon price. If you or your agent are aware of recent sales that could be considered in the report, provide them to your appraiser.

Is a home appraisal worth it?

Drive-bys involve the appraiser viewing the exterior of the house and then drawing comps. Mortgage companies will not typically allow these to secure a home mortgage. However, they may use them for other forms of lending, such as lines of credit or a refinance, if you have sufficient equity in your home. Other reasons for a drive-by valuation may be to get a basic valuation of a house in the foreclosure process. That may also mean the cost of buying a home is at a historic high, although property buyers in the 1980s dealt with mortgage rates that were significantly higher than today's loans.

Buyer beware: Appraisers bidding up fees after loan applications - OCRegister

Buyer beware: Appraisers bidding up fees after loan applications.

Posted: Thu, 24 Jun 2021 07:00:00 GMT [source]

How Often Do Home Appraisals Come in Low?

An example would be if the appraiser did not realize you had put a new roof on the house or that your neighborhood had an amenity center with a pool. These situations are the stuff of nightmares for buyers and sellers alike. If you are desperate to sell and the report comes back lower than the offer, you can always offer to pay more closing costs. If the sellers priced their home too low, they may not recover all the equity they have acquired while owning the property, essentially leaving money on the table. Even though most lenders require an appraisal as a condition of closing on a house, the buyer pays for the appraisal unless they negotiate for the seller to pay instead. Because most lenders won’t issue a mortgage without one, an appraisal is usually a central part of the closing process.

Faster, easier mortgage lending

A home appraiser will take into account visible defects, such as a caved-in roof or an improperly functioning plumbing system, but an appraiser doesn’t search for specific problems. Instead, the appraiser mainly looks for an overall value to assign to the property, without digging for deeper issues that can impact how much you’ll end up spending to repair the home. An appraiser might require a specific type of inspection if there are safety concerns. An appraisal differs from a home inspection, which is a much more in-depth process. In a home inspection, an inspector specifically looks for problems in the home and determines whether certain areas need repairs.

More likely, homeowners and real estate agents may use it to help determine a home’s listing price. If you are listing your home through a real estate agent, the price you have on the house is fairly on point. If this happens, the homeowner can write a letter and ask for an appeal. Keep in mind that this will only work if there is proof that the original appraisal was incorrect.

This is the most common type of home appraisal out there and lenders typically require a URAR before approving your mortgage. Some factors would not negatively affect an appraisal but can leave a bad impression on an appraiser and cause a slightly lower evaluation. While they follow a basic checklist, certain things may make them see your house in a favorable light.

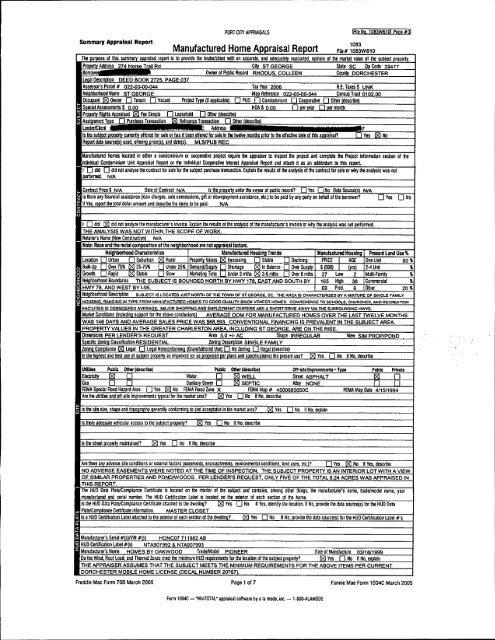

How to Contest a Real Estate Appraisal

This is by far the most common form of house evaluation still used and the one most often required when obtaining a mortgage for a home. With this type of process, there will be a complete onsite evaluation of the home, the property, and the neighborhood to draw an accurate price. Since this is the most accurate and time-consuming type of evaluation, it comes with a higher price tag. During the process, the appraiser collects data on the interior and exterior of the home, including the condition, and compares it with recent sales in the area to determine the value. A home appraisal is conducted by a licensed professional to determine what your home is worth.

FHA Appraisal

Examples include a snow-covered roof or locating a well and septic that aren’t marked on the property sketch. Let’s take a look at the main factors that impact the cost of a home appraisal as well as what to expect from the process. Angi pegs the average cost of a home appraisal at $356, but the National Association of Realtors®’ (NAR) 2023 Appraisal Survey suggests that it’s more like $500. Costs will vary based on what area of the country you live in, the type of home, its square footage, condition, and more.

Or they will end up taking on more risk in the event the homebuyer defaults on their loan payments and go into bankruptcy. In this instance, the lender might not be able to sell the home for the same amount of money it loaned the homebuyer and would lose money. While the average home appraisal costs just $350, several cost factors can drive up that price. Online valuations are best used in the early research stages of buying or selling a home. The free valuations rely on publicly available data and do not consider the home's condition or updates which can greatly impact the home's value. In most cases, the buyer pays for the home appraisal as part of their closing costs.

In a real estate transaction, the appraisal is typically ordered by the buyer’s mortgage lender and paid for by the homebuyer. There are three situations where the lender may order a second appraisal. If it has been three to six months since the original evaluation, the lender will order a second one to ensure no changes have occurred.

Based on the information you have provided, you are eligible to continue your home loan process online with Rocket Mortgage. A professional appraiser’s fees are regulated in part by federal law — the Dodd-Frank Wall Street Reform and Consumer Protection Act — and must be reasonable and customary for the geographic market. Before you have a home appraised, know the four important factors that can affect the cost of your home appraisal. Obviously, upgrading or renovating increases the appraised value of your home when you are refinancing. Making sure the house is clean, well-organized, and free of clutter also helps. The Income Approach Appraisal is generally used for income-producing properties, like rent houses.

No comments:

Post a Comment